The EAST AFRICAN AGREES WITH THE SAFARICOM POST

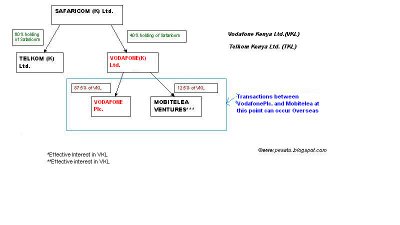

The Current issue of the East African summarizes what was in my earlier posts on the Safaricom/Mobitelea issue.

-http://pesatu.blogspot.com/2006/11/extremely-simplified-safaricomvodafone.html#links

-http://pesatu.blogspot.com/2006/11/safaricom-mobitelea-ask-sarin-here-is.html#links

They have a better graph of the shareholder structure.

However, the graph showing the present day shareholder structure of SAFARICOM K Ltd. has an error. It shows Telkom Kenya Ltd. having a 60% stake in Safaricom and Vodafone K ltd with a 35% stake in Safaricom instead of a 40% stake.

The 87.5% stake in VKL by Vodafone Plc. and 12.5% stake by Mobitelea ventures is accurate.

The article also says that the Parliamentary Investment Committee (PIC) has summoned the Registrar of Companies and the Safaricom M.D. to explain the matter.

The following issues could thwart the PIC effort:

1.Mobitelea Ventures could be registered offshore, so no record of it may be at the Kenyan Company registry.

2.Safaricom officials may claim to only know about Safaricom Kenya Ltd. matters i.e. they are not Vodafone Plc or Vodafone K ltd employees. As such they can’t shed any light on Mobitelea or Vodafone Kenya Ltd. Shareholding.

It is akin to asking Gerald Mahinda(MD -EABL) to comment on SABMiller Plc's affairs because SABMiller Plc has a 20% stake in Kenya Breweries Ltd(an EABL subsidiary).He can't since neither he nor EABL are members of SABMiller Plc.

NB: the article is in the current Print Edition and may take a while to appear online.

New Music: Zinoleesky – Elements

-

Following the release of his first single in January, “Sunny Ade,”

singer-songwriter Zinoleesky is back with his second single, “Elements.”

“Elements” pr...

12 hours ago